Regardless of the kind of company you own, or what industry you operate in, if you want to grow your business, you’ve got to give your customers what they want.

This idea that the customer’s always right certainly isn’t a new one, but it’s been given new meaning with the rise of contactless payment solutions.

Being able to simply tap your credit card, smartphone, or other device has become increasingly popular in recent years, not least as a result of the pandemic.

Like it or not, many people today would prefer to avoid touching a payment terminal, and this has caused the popularity of contactless payments to skyrocket like never before.

A survey from Mastercard of 17,000 consumers across 19 countries found that nearly eight in 10 respondents make use of contactless payment solutions.

What’s more, the survey found that 82 per cent of respondents consider contactless payments to be “the cleaner way to pay” and 74 per cent of them said they planned to continue using contactless payments post-pandemic.

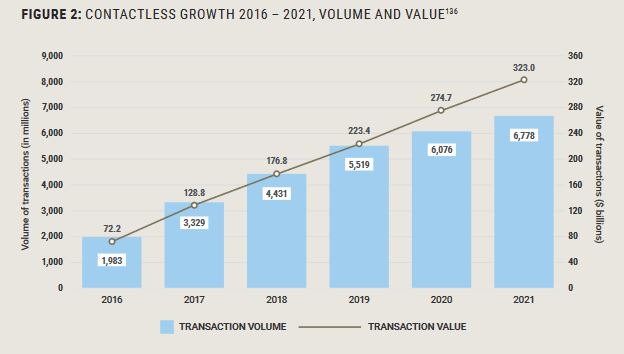

In addition, as you can see from the graph below, a report from Payments Canada, published in 2022, found that between 2020 and 2021, the volume and value of contactless payments increased by 12 per cent and 18 per cent, respectively.

The report also found that due to the pandemic, 43 per cent of Canadians have changed their payment preferences to “digital and contactless for the long-term.”

Moreover, about one-third of Canadians said they’re uncomfortable touching a payment terminal, and more than a quarter said one of their biggest frustrations when making in-store payments is when stores don’t offer a contactless option.

At the same time, the majority of Canadian merchants are now giving consumers what they want, as a study from the Bank of Canada found that in 2021 and 2022, 81 per cent of merchants surveyed said they offer contactless payment solutions in their stores.

All things considered, clearly this trend toward contactless payments isn’t going anywhere. Consumers from around the world, and right here in Canada, want this option to be available, and the reality is, business owners who don’t offer it are going to get left in the dust.

So, if you want to start offering contactless payment solutions, or you’re not quite sure what they are, but you want to learn more about this technology, and how it can benefit your business, then you should definitely keep reading.

Because in this article, we’re going to explain what contactless payments are, and how they work, and explore the benefits of this ever-more popular and convenient payment option.

What Are Contactless Payments and How Do They Work?

The term contactless payments refers to a form of payment where the customer doesn’t need to physically insert their card into a card reader or enter a PIN.

Instead, they can simply wave or tap their contactless-enabled card, smartphone, or wearable device (such as a smartwatch) near a contactless-enabled payment terminal to complete the transaction.

Here’s how contactless payments work:

Card or Device: Customers use a contactless-enabled debit or credit card, a smartphone with mobile payment capabilities (like Apple Pay, Google Pay, or Samsung Pay), or a wearable device equipped with contactless technology.

Payment Terminal: Merchants or businesses need to have a contactless payment terminal or point-of-sale (POS) system. These terminals are equipped with near-field communication (NFC) technology that enables them to communicate wirelessly with the customer’s card or device.

Tap or Wave: To make a payment, the customer holds their contactless card, smartphone, or wearable device within a few inches of the payment terminal. There’s no need to swipe, insert, or type in a PIN.

Authorization: The payment terminal securely communicates with the card or device to process the transaction. Depending on the transaction amount and the specific regulations, the customer might be prompted to enter a PIN for security verification.

Confirmation: Once the payment is authorized, the terminal provides a confirmation, usually with a beep or a visual cue, indicating that the transaction is complete. The process is quick and efficient, often taking just a few seconds.

So, now that you have a better understanding of what contactless payments are, and how they work, let’s take a look at how contactless payment solutions can benefit your business.

The Benefits of Contactless Payment Solutions

Contactless payments have emerged as a game-changing innovation that is reshaping the way transactions are conducted.

With their undeniable convenience, security, and efficiency, contactless payment solutions hold tremendous potential to benefit both consumers and business owners.

With that in mind, let’s explore the myriad ways in which contactless payments can make your customers happy and benefit your business.

Enhanced Customer Experience

For both business owners and consumers, one of the most significant advantages of contactless payments lies in the enhanced customer experience they offer.

In an era where speed and convenience reign supreme, customers are drawn to establishments that provide hassle-free, convenient, and quick payment methods.

Contactless payment solutions fulfill this demand by drastically reducing transaction times. With a simple tap or wave, customers can complete their purchases swiftly, eliminating the need for them to fumble with cash or enter PINs.

The result? Satisfied customers who are more likely to return, spread positive word-of-mouth, and contribute to increased patronage and higher sales.

Streamlined Operations

For business owners, time is often a precious commodity, but contactless payment solutions can help to streamline your operations by speeding up the payment process.

The reduced time spent on each transaction translates into shorter lines, faster checkout, and improved overall operational efficiency.

This efficiency gain can also have a ripple effect on various aspects of your business, allowing you and your employees to spend more time focusing on other critical tasks, such as customer service and inventory management.

Increased Sales Opportunities

Contactless payment solutions can open up new avenues for you to capture sales that you might have been missing before.

By embracing this technology, your business can tap into a broader customer base, including tech-savvy individuals who prefer cashless transactions.

Moreover, contactless payments can facilitate impulse purchases, as customers are more likely to make quick buying decisions when the checkout process is frictionless. For businesses operating in competitive markets, this could translate into a significant boost in revenue.

Data-Driven Insights

In the digital age, data is king. That being said, contactless payment systems can provide you with valuable insights into your customers’ behaviour and preferences.

And by analyzing that transaction data, you can gain a deeper understanding of your customers, which allows you to tailor your offerings, promotions, and marketing strategies accordingly.

This data-driven approach can help you to make informed decisions that can drive growth and optimize your operations.

Cost Savings

While the initial setup costs for contactless payment systems may seem like an investment, they can lead to substantial cost savings in the long run.

Handling and processing cash transactions can incur expenses related to cash management, security, and banking fees. But by offering contactless payment solutions, you can reduce your reliance on cash, thereby cutting down on associated costs.

Additionally, the digital nature of contactless transactions helps to reduce the need for paper receipts, which also contributes to these kinds of cost-effective practices.

Security and Trust

Contactless payments are built on robust security measures, including encryption and tokenization, which safeguard sensitive customer data.

This level of security not only protects customers but also fosters a sense of trust and credibility for your business.

In an age where data breaches and fraud are prevalent concerns, offering secure payment options can set your business apart and establish a reputation for prioritizing the security of your customers.

Adapting to Changing Trends

The world of commerce is evolving rapidly, and as a business owner, you’ve got to adapt to stay relevant.

With that in mind, contactless payment solutions represent an essential step toward the modernization of your business.

And by embracing this technology, you can demonstrate your willingness to evolve with changing consumer preferences, positioning your business as a forward-thinking and innovative establishment.

Contactless payments are ushering in a new era of convenience and efficiency, and for business owners, particularly those running small and medium-sized enterprises, the benefits are both tangible and transformative.

From enhancing customer experiences and streamlining operations to increasing sales opportunities and providing data-driven insights, the impact of contactless payment solutions is profound.

And as the business landscape continues to evolve, harnessing the power of contactless payments isn’t just a financial transaction – it’s an investment in the future success of your business that can foster growth, customer loyalty, and innovation.

Do you want your business to be able to accept contactless payments? Give us a call today to find out how we can help.