As much as we hate to say it, the truth is Canada’s economy is not doing very well.

After several years of unprecedented business disruptions, along with soaring inflation and interest rates, Canadians aren’t spending the way they used to, and businesses that have made it through these trying times are feeling the pinch like never before.

With that in mind, many merchants are trying to cut costs in any way they can, and one of the ways they’re doing that is by trying to save money on credit card processing fees.

A CFIB survey from earlier this year found that 81 per cent of Canadian small businesses have had to “take a hit to their bottom line to cover the costs of accepting credit cards.”

What’s more, the survey found that 74 per cent of small business owners in Canada want credit card processing fees to be lowered to no more than one per cent of the value of a transaction.

Fortunately, as we covered in our June article, after many years of dealing with some of the highest interchange fees in the world, Canadian merchants celebrated a considerable win when the federal government made a deal with Visa and Mastercard to lower interchange fees for small businesses.

These changes, which will come into effect in the fall of next year, are projected to allow over 90 per cent of small businesses to qualify for lower interchange rates, which could reduce the fees they pay by up to 27 per cent.

But it’s important to point out that interchange fees are just one part of the cost of accepting credit cards, and with Canadian consumers continuing to spend significantly less, small business owners are making fewer sales, which makes it even more important for them to do everything they can to save money.

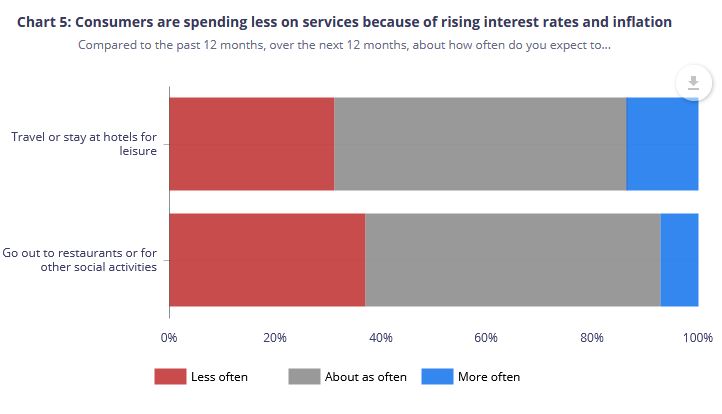

For instance, as you can see from the graph below, a Bank of Canada survey found that as a result of rising inflation and interest rates, many Canadian consumers are choosing to spend less on services.

All things considered, even with the upcoming reductions in interchange fees, many Canadian merchants are still struggling to keep their businesses afloat.

With that in mind, we wanted to provide some relief for Canadian business owners like you by offering tips on how you can save money on credit card processing fees.

So, if you’re sick of paying so much to accept payments with credit cards, and you want to learn how to save on credit card processing, then you’re going to want to keep reading.

Because in this article, we’re going to explore the costs associated with credit card processing, and offer a few tips to help you save money on credit card processing fees.

What Are the Costs Associated with Credit Card Processing Fees?

As we’ve already explained, interchange fees account for just one of the many costs associated with credit card processing fees.

To put things in perspective, a report from the Bank of Canada found that in 2018 alone, Canadian merchants paid more than $11 billion to accept credit card payments, and for many merchants, this can add up to thousands of dollars in fees every year.

That being said, credit card processing fees include:

- Per-transaction fees: These fees are collected by multiple parties involved in a credit card transaction, including the card issuing bank, credit card companies like Visa and Mastercard, merchant account providers, payment gateways, payment processors/ISOs, and payment card terminal providers.

- Assessment fees: Assessment fees are collected by card networks, such as Visa, MasterCard, American Express, and Discover, and are essentially fees for providing the infrastructure and services that enable credit card transactions. Typically, they’re charged to the acquiring banks or merchant account providers, who may pass some or all of these fees on to merchants.

- Interchange fees: While card networks like Visa and Mastercard set the rates for these fees, they don’t actually profit from them. Interchange fees help to cover the cost of facilitating electronic payments and are collected by banks and other organizations that issue credit cards.

- Equipment fees: These fees are typically charged by companies that provide payment processing hardware and equipment to merchants, such as payment terminals, in order to cover the cost of leasing or purchasing the physical equipment needed to accept credit card payments.

- Statement fees: Statement fees are often charged by payment processors, and are meant to cover the cost of providing monthly statements to merchants, which typically contain important information about a merchant’s transactions, fees, and other account details.

In addition to all of these fees, payment processing providers, like Lucid Payments, will add their own markup to merchants’ bills, and this is how we make our money.

And even though we refuse to do this ourselves, and passionately oppose this practice, it’s important to point out that payment processing providers are notorious for adding miscellaneous fees to merchants’ bills, especially when interchange fees go down.

This way, instead of passing the interchange savings onto their customers, providers will take advantage of unsuspecting merchants by padding their bills with these extra fees.

So, as you can see, there are a ridiculous number of fees associated with payment processing, and some pretty underhanded stuff happening. Moreover, the whole thing is so convoluted that it can be tough for business owners to understand what they’re even being charged for, or who’s profiting from these fees.

But now that you have a better understanding of the various fees paid by merchants like you, and who’s actually profiting from them, let’s explore how you can save money on credit card processing fees.

How to Save Money on Credit Card Processing Fees

In spite of the exorbitant amount of money many Canadian merchants are forced to pay in order to accept credit card payments, there are things you can do to save on these fees.

Here are some tips to help you minimize the cost of credit card processing fees for your business:

Do Your Research

Unfortunately, with the payment processing industry being as convoluted and deceptive as it is, if you want to save money on credit card processing fees, and avoid getting bamboozled, you’re going to have to do a diligent amount of research.

Before signing a contract with a payment processor, for instance, make sure to thoroughly review the terms and conditions, paying close attention to cancellation fees and contract lengths.

Also, try to stay up to date on what’s going on in the payment processing industry, particularly when it comes to legislation, deals between government and industry, and changes in interchange rates.

In addition, make sure to regularly review your monthly statements to check for errors, unexpected fees, or anything else that doesn’t seem right, and promptly address any discrepancies.

And if interchange rates are going down, don’t forget to check if these savings are reflected on your statement, and if they’re not, you should contact your provider and ask why.

Sadly, these statements can be difficult to decipher, so if you’re unsure about anything, or you want a second opinion, don’t hesitate to contact us.

We’ll be more than happy to review your statement with you, explain anything you don’t understand, and see if we can offer you a better deal.

Provide Incentives

The interchange rates imposed on credit card transactions can be vastly different based on the kind of card that’s being used.

Credit cards that offer rewards programs, for instance, tend to have significantly higher rates, often costing more than double what other credit cards would.

Now, obviously, you don’t want to turn customers away by refusing to accept their cards, but there are ways to encourage people to use other forms of payment, and if people are willing to do so, it could end up saving you quite a bit of money.

For example, you can offer discounts to customers who agree to pay with cash, debit, or even mobile wallets like Apple Pay, Google Pay, or PayPal, which often have lower processing fees compared to traditional credit cards.

You can also consider imposing a minimum purchase amount on credit card payments to try to deter people, but be aware that some provinces in Canada have regulations around this, so keep that in mind.

Prioritize Card-Present Transactions

Any time a customer pays for something without their card present, or without entering their PIN, regardless of whether it’s done online or in person, that transaction is going to cost more because it carries a higher risk of fraud.

Even tapping a credit card will cost a bit more because a PIN isn’t required, and therefore, the transaction is considered less secure.

Like it or not, inserting a credit card into a payment terminal and entering a PIN is one of the most secure ways to pay, and therefore, the interchange fees charged on these transactions will always be lower.

Unfortunately, some merchants do most of their business online and/or over the phone, so this strategy isn’t always viable.

But if you can find a way to prioritize card-present transactions, where customers insert their physical card and enter their PIN, this can help you to reduce your credit card processing fees.

Don’t Assume a Bank Is Better

We can’t tell you how many times we’ve heard people say that they’d prefer to go with a bank or a bank-owned payment processor because they have “better security” or can offer a better deal.

We’re not sure how these myths began, but this couldn’t be further from the truth.

Plenty of the big banks have had massive data breaches in recent years, and they’re actually more likely to get hacked, as they have many more customers, so there’s more incentive to do so.

At the same time, every provider of payment processing is expected to follow the same security protocols, and those who don’t comply are subject to massive fines or being blacklisted from the industry altogether.

What’s more, banks have massive overheads, so they have to charge more, and we’ve looked at more than enough statements to know that this is the case.

That being said, you’re much more likely to save money by choosing a smaller local provider.

If you want to learn more about why you shouldn’t assume a bank is better, you can check out our article on Two of the Biggest Myths About Payment Processing.

Avoid Flat-Rate Pricing

Some providers offer flat-rate pricing, which allows you to pay a fixed percentage or per-transaction fee, regardless of what kind of card a customer is using.

These offers are advertised as a way to help merchants save money, and have a better idea of how much they’re going to be paying each month, but don’t be fooled.

Typically, the rates you’ll pay for this kind of pricing are considerably higher than what you’d have to pay on most credit cards, and as a result, this flat-rate pricing will probably end up costing you more.

Are you looking to save money on credit card processing fees, or just trying to make sense of your statement? Give us a call today to find out how we can help.