As we’ve said countless times before, the payment processing industry suffers from a serious lack of clarity.

Business owners don’t understand it, processors aren’t making it any easier to understand, and unfortunately, they’re benefiting from maintaining that status quo.

We, on the other hand, have chosen to take a different approach by putting the best interests of business owners like you first and ensuring you have absolute clarity when it comes to your payment processing.

With that in mind, we’ve held our tongue for quite some time now, but we’re tired of beating around the bush while business owners get bamboozled, so we figured it was time to start doing direct comparisons between Lucid Payments and some of the giants of our industry.

But we’re not here to just give you a sales pitch, and we’re not looking to throw stones either.

All we want to do is provide an honest comparison of Lucid Payments vs. Square, so you can make up your own mind as to which processor will be best for your business.

So, if you’re looking for the best interchange rates, wondering what the difference is between interchange plus vs. flat rate pricing, or just want a direct comparison of Lucid Payments vs. Square, then keep reading to learn more.

Lucid Payments vs. Square: What’s the Difference?

If you want to choose the best payment processor for your business, then you need to compare what the various processors are offering.

And while that may seem simple, if you don’t have a firm grasp of how our industry works, particularly when it comes to interchange rates, then regardless of how much you compare, you’re probably not getting the whole picture.

With that in mind, below we’ve done a direct comparison of Lucid Payments vs. Square, and provided proper context, so you can come to your own conclusions.

Interchange Plus vs. Flat Rate Pricing

If there’s one thing business owners are most confused about when it comes to payment processing, it’s got to be interchange fees.

Hopefully, you’re aware of what they are and how they work, but if you want more information, you can check out our article on What You Need to Know About Interchange Rates in Canada.

In a nutshell, when you accept payments with credit cards or debit cards, you’ll have to pay a percentage of the cost of each transaction in what’s known as interchange fees.

The rates at which you’ll pay these fees are variable, and they’re based on things like the nature of the transaction, the industry in which you’re operating, and the type of card the customer is using.

That being said, one of Square’s perceived selling points is its flat rate pricing, which it refers to as being simpler, as you’re paying the same rate no matter what card a customer uses.

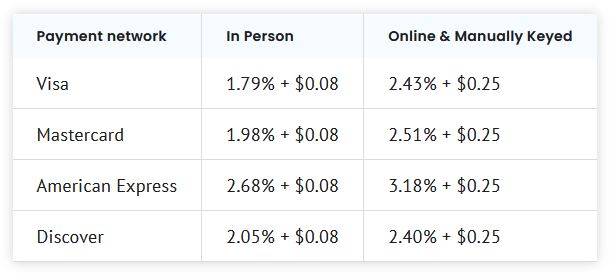

But as you can see below, according to an article from The Ascent, the average interchange rates on most credit card transactions are actually much lower than Square’s flat rate of 2.65% for an in-person transaction.

On average, three out of these four cards will cost you less than what you’d pay with Square, and when you start doing card-not-present transactions, that’s where things really start to get expensive.

For instance, for card-not-present transactions, like when someone buys something on your website, Square will charge you 2.9% plus a fee of 30 cents per transaction.

And if you’re keying in the information yourself, as you’d do when taking orders over the phone, it’s going to cost you 3.4% plus 15 cents per transaction, which is considerably higher than the rates on any of these cards, regardless of the nature of the transaction.

As you can tell, the issue with flat-rate pricing, despite it being advertised on its simplicity, is that the rates have to be high enough to cover the interchange rates on all possible cards.

But the truth is the rates on most cards will cost you far less than what Square’s charging.

So, while you may be able to make the argument that this is simpler, you can’t honestly say it’s more affordable.

With that in mind, our interchange plus pricing ensures you’ll be charged whatever the rate is on a given card, allowing you to avoid paying exorbitant flat-rate fees and ensure you’re always getting the best possible rate.

For example, if a customer makes a purchase with a Mastercard that has an interchange rate of 0.92%, with us you would pay 0.92% for that card, but with Square, you’d still be paying a whopping 2.65%.

Transaction Limits

Square, which uses a third-party processor, is notorious for imposing transaction limits that can stifle your ability to grow your business.

They typically impose these limits on new users, and those who have a lot of payment disputes, erratic activity on their account, or are selling high-risk goods or services.

And regardless of why they’re doing it, if they choose to impose a transaction limit on your account, when you go over that limit, they’ll start holding your funds.

But when you work directly with a payment processor, as you would with Lucid Payments, you’ll never have to deal with any of those limitations.

Canadian vs. American

We’re staunch supporters of both shopping local and supporting Canadian-owned businesses whenever possible, and we’re proud to say that we’re 100% Canadian-owned and operated.

Unfortunately, our industry is dominated by multinational conglomerates, most of which are American-owned, including Square.

That may not mean much to you, but from our perspective, it’s more important than ever for Canadians to keep our hard-earned dollars within our borders, not least with all the economic uncertainty we’re currently facing.

Statement and Equipment Fees

Another one of Square’s perceived selling points is that it doesn’t charge any monthly statement fees or fees to rent payment terminals.

We, on the other hand, do charge a $5 monthly statement fee, and $50 per month to rent a payment terminal, so in this aspect, Square’s got us beat.

But if you’re spending an extra 1.5% or more on most transactions, those fees can quickly add up to way more than $55 per month, and if that’s the case, you won’t be saving anything.

Want to learn more about how Lucid Payments can benefit your business? Contact us today to find out how we can help.