After being in the payment processing industry for more than a decade now, it’s crazy to think back to how primitive things were when we got started.

Back then, people were still swiping their credit cards, while mobile payment processing was a relatively new concept, and it’s funny to think about how foreign that sounds, just ten years later.

But today, we’ve reached a point where people don’t want to carry a piece of plastic around with them to make payments, and many of us, particularly younger generations, would prefer that everything is done through our devices.

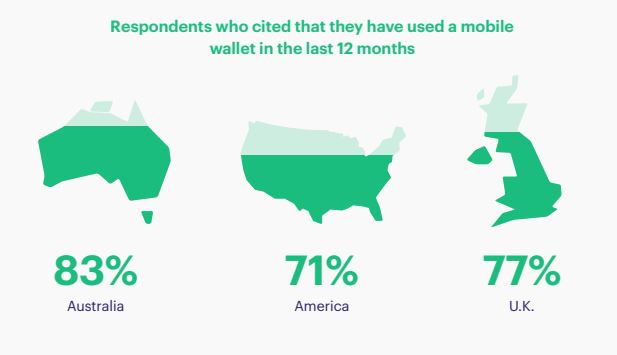

A report from Marqeta published last year, which surveyed more than 4,000 people from across the United States, Australia, and the U.K., found that the vast majority of respondents from all three of these countries had used a mobile wallet in the previous 12 months.

What’s more, 67 per cent of respondents said they now prefer using mobile payments, as opposed to other forms of payment, as they tend to have more security features.

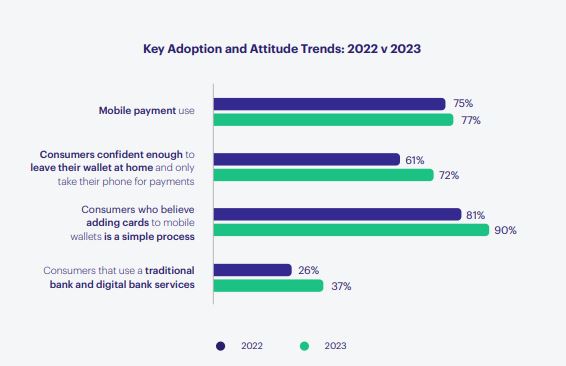

In addition, another report from Marqeta, published this year, which also surveyed thousands of consumers from the United States, Australia, and the U.K., found similarly significant statistics related to mobile payments.

As you can see from the graphs below, when comparing this year’s report to the same report from last year, the use of mobile payments has increased slightly, from 75 to 77 per cent, and the number of consumers who feel confident enough to leave their physical wallet at home and rely solely on mobile payment processing has shot up by more than 10 per cent.

And after everything that played out during the pandemic, the adoption of mobile payment processing seems like it will only continue to increase.

More than two-thirds of respondents to Marqeta’s 2022 survey said that the pandemic increased their use of mobile wallets.

And here in Canada, the pandemic seems to have had the same effect.

According to a report from Payments Canada, in 2022, the volume of mobile payments in Canada had grown by 17 per cent since 2020.

And in 2021, 45 per cent of Canadians who have used their mobile wallet to make purchases said that since the pandemic started, they’d been using it more than they used to.

All things considered, it’s obvious that the trend toward greater adoption of mobile payment processing isn’t going anywhere, not least due to the convenience and added security that this technology affords.

So, if you’re looking to learn more about mobile payment technology, or just asking yourself, “What is mobile payment processing?” then you’re going to want to keep reading.

Because in this article, we’re going to explain what mobile payment processing is and explore some of the biggest trends and innovations in mobile payment technology.

What Is Mobile Payment Processing?

The term mobile payment processing refers to the technology and systems that enable the acceptance and processing of payments through mobile devices, such as smartphones and tablets.

This includes things like Apple Pay, Google Pay, QR code payments, banking apps, and mobile wallets, which allow people to make payments for goods and services using their mobile devices.

These technologies offer a convenient and efficient alternative to traditional cash or credit card transactions, along with a litany of other advantages for both consumers and businesses alike.

Mobile payment processing provides numerous benefits, including faster transactions, enhanced convenience and security, and reduced reliance on physical cash or cards, and has become increasingly popular as more people adopt smartphones and mobile technology becomes more advanced and secure.

If you want to learn more about how mobile payment processing can benefit your business, you should check out our article on How a Virtual Payment Terminal Can Cut the Cost of Payment Processing.

And with that, let’s take a look at some of the hottest trends and most interesting innovations in the world of mobile payment technology.

Trends and Innovations in Mobile Payment Technology

Contactless Payments

Contactless payments have gained significant popularity, especially in the wake of the COVID-19 pandemic. The use of Near Field Communication (NFC) and other technologies allows consumers to make payments by simply tapping their mobile devices or payment cards on compatible terminals, providing a convenient and secure payment experience.

But it’s important to remember that contactless payments made using mobile devices are still considered card-not-present transactions, so they can be a bit more expensive for business owners when it comes to interchange fees.

All things considered, this is still a great form of payment for both consumers and business owners, as it offers speed and convenience on both ends of a transaction.

Digital Wallets

Digital wallets are mobile applications that store payment information, such as credit card details, and enable users to make payments digitally. Popular examples include Apple Pay, Google Pay, and Samsung Pay. These wallets offer convenience, security, and integration with other services, making them a key trend in mobile payment technology, and an increasingly popular one, as well.

According to Marqeta’s 2022 report, the vast majority of respondents aged 18 to 24 said they’re “comfortable leaving their wallet at home in favor of their phone”.

However, it’s important to be aware of the risks associated with this form of payment.

For example, if you lose your phone or break it, and you don’t have any other form of payment on you, then you’re pretty much out of luck, so make sure to keep that in mind.

Biometric Authentication

Biometric authentication methods, such as fingerprint scanning and voice, iris, or facial recognition, are increasingly being integrated into mobile payment solutions. These technologies provide an additional layer of security and streamline the payment process by eliminating the need for passwords or PINs.

That being said, if you’re going to use any kind of mobile payment technology, make sure to protect your phone using some form of authentication, so you’re the only person who can unlock it, and someone can’t just pick it up and start making purchases.

Peer-to-Peer (P2P) Payments

P2P payment apps allow users to send and receive money directly from their mobile devices, often with minimal or no fees. Services like Venmo, PayPal, and Zelle have gained popularity, enabling users to split bills, repay debts, or transfer money to friends and family seamlessly.

This form of payment is also becoming increasingly popular, as Marqeta’s 2022 report shows, with 76 per cent of respondents saying they’d used a peer-to-peer payment app within the previous 12 months.

In-App Payments

Mobile apps are integrating payment capabilities directly into their interfaces, allowing users to make purchases without leaving the app. This trend simplifies the checkout process, reduces friction, and enhances the overall user experience.

But if you are going to make in-app payments, make sure to check that the app you’re using is properly encrypted. You can confirm this by ensuring the company that offers the app has a certificate of encryption listed on their website, or within the app itself.

And if you want to integrate in-app payments into your own applications, make sure to instill confidence in consumers by prominently displaying your certificate of encryption.

Internet of Things (IoT) Integration

The integration of mobile payment technology with IoT devices is an emerging trend. IoT devices, such as smartwatches, connected cars, and smart home devices, can facilitate seamless payments by leveraging mobile payment capabilities. For example, a smartwatch with NFC technology can be used to make payments at compatible terminals.

Wearable Payments

Wearable devices, such as smartwatches, fitness trackers, and payment-enabled jewelry, offer a convenient and hands-free way to make payments. These devices often utilize NFC or other technologies to enable contactless payments on the go.

And according to Payments Canada’s report, although they only accounted for less than one per cent of contactless payment transactions in 2021, Canadians’ use of wearable payments went up during that year, with a 33 per cent increase in volume, and a 41 per cent increase in value.

Cryptocurrency Integration

Some mobile payment solutions are starting to integrate support for cryptocurrencies, allowing users to make payments using digital currencies like Bitcoin or Ethereum. This trend adds new possibilities for mobile payments and may contribute to the wider adoption of cryptocurrencies.

Many people are still unfamiliar with cryptocurrency, but as Marqeta’s 2022 report found, there are a significant number of consumers using mobile payment technology in relation to crypto, with 31 per cent of respondents saying they’ve used a peer-to-peer payment app to trade cryptocurrency.

QR Code Payments

QR code-based payment methods are becoming increasingly popular, particularly in emerging markets. Users can scan QR codes with their mobile devices to initiate payments, enabling small businesses and individuals to accept digital payments easily.

And aside from just using it as a form of mobile payment, this technology is also very promising for businesses, especially when it comes to things like customer retention and loyalty. For example, if you have a points program, QR codes can be used as a quick and convenient way for customers to add points to their accounts by simply scanning the code.

Enhanced Security Measures

With the rise in mobile payment adoption, there is a growing focus on implementing robust security measures. This includes tokenization, encryption, secure elements, and continuous advancements in fraud detection and prevention technologies to safeguard user information and the integrity of transactions.

Do you want to make sure your business is able to process mobile payments? We provide only the most up-to-date equipment and superior setup and support services. Give us a call today to find out how we can help.