As a business owner, you need to be able to process payments.

The world is moving further and further away from cash, and if you don’t have the ability to accept other forms of payment, you’re going to get left in the dust.

At the same time, you want to ensure you’re equipped with the best possible payment terminal, and ideally, you want one that gives you the ability to process payments on the go.

For many business owners, portable payment terminals are absolutely essential.

If you own a pizzeria, for instance, and you’re delivering orders to customers, you can’t expect everyone to pay in cash, and you can’t run an ethernet cable all the way from your restaurant to their homes, either.

But trying to wrap your head around the specifications of a payment terminal can be a daunting task, so most business owners just take whatever terminal they’re given.

Unfortunately, this results in a lot of people getting ripped off, as many companies are still offering outdated, obsolete terminals.

So, if you want to avoid this happening to you, and you want to know how to choose the right payment terminal for your business, then keep reading.

In this article, we’re going to give our recommendations for what we feel are the best portable payment terminals on the market, and offer some advice so you can avoid being tricked into taking some beat-up old terminal.

The Best Portable Payment Terminals

In our opinion, the Move/5000 and the Poynt 5 smart terminal are the best portable payment terminals on the market.

We recommend these terminals because they offer unmatched speed, security, versatility, and a plethora of other features to help businesses run more efficiently.

Move/5000

The Move/5000 is built for mobility and offers superior speed, an intuitive user interface, and the ability to accept virtually any form of payment.

The Move/5000 is built for mobility and offers superior speed, an intuitive user interface, and the ability to accept virtually any form of payment.

This terminal is PCI certified, so it meets all the latest security requirements, and it also allows you to accept the newest and most popular forms of payment, including chip-and-PIN cards, contactless payments, and smart cards, such as Google Pay and Apple Pay.

In addition, it offers access to real-time reporting from both the device and your computer and allows you to connect to the Internet via Wi-Fi, Bluetooth, or 4G/LTE.

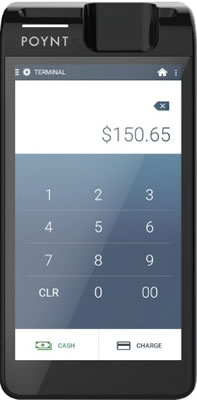

Poynt 5

The Poynt 5 smart terminal features top-notch speed, a user-friendly interface, and the ability to accept basically every form of payment, including contactless payments, chip-and-PIN cards, and smart cards like Apple Pay and Google Pay.

The Poynt 5 smart terminal features top-notch speed, a user-friendly interface, and the ability to accept basically every form of payment, including contactless payments, chip-and-PIN cards, and smart cards like Apple Pay and Google Pay.

It’s also PCI certified and provides multiple connectivity options, including Wi-Fi, Bluetooth, and 3G/LTE.

The Poynt 5 also offers a unique set of smart capabilities, such as the option to access real-time reporting from an app on your smartphone.

It lets you send customers’ receipts directly to their e-mail or phone and delivers a plethora of downloadable apps for things like appointment booking, inventory management, and linking your terminal to accounting software.

Things to Consider When Picking a Payment Terminal

No matter what payment terminal you want to use, there are several things to consider.

Even if you don’t want to go with one of the terminals we’ve recommended above, having a better understanding of the following three points will allow you to make the best possible decision.

Security

One of the most important things to consider when it comes to the security of a payment terminal is whether it has up-to-date PCI certification.

This certification shows that the device adheres to the guidelines set by the PCI Security Standards Council (PCI SSC), which sets standards related to the security of card transactions and the protection of cardholders’ information.

If you want to learn more about these standards, check out our article on How to Choose The Best Payment Processing Provider.

Besides PCI certification, another thing to think about in terms of the security of a payment terminal is its ability to accept all the newest forms of payment.

Contactless payments, chip-and-PIN cards, and smart cards offer some of the best security features, including tokenization, encryption, and near-field communication, making them significantly more secure than standard magnetic stripe cards.

So, if you’re using a terminal that’s incapable of accepting these kinds of payments, every transaction you process is likely to be less secure.

That being said, no matter what payment terminal you choose, if you want the best security, you should make sure it’s capable of accepting these forms of payment.

Infrastructure

Believe it or not, some of the largest payment processing companies in the world are still using decades-old infrastructure so they can save money at the expense of their customers.

As a result, merchants end up dealing with slower speeds on their payment terminals, and annoyingly frequent updates, fixes, and patches.

This can create embarrassing situations for business owners, who might not be aware of the need to download a specific update until a customer can’t pay because their terminal’s not working.

Now, most payment processors aren’t going to admit how old their infrastructure is, and if you ask them about this, it might be difficult to get a straight answer.

But if you want to avoid being embarrassed or inconvenienced, and be able to process payments as quickly as possible, you should do a bit of research.

One of the things you can do is to try looking up some reviews on the companies you’re considering to find out what types of issues their customers are having.

If customers are complaining about constant updates, for instance, that should tell you everything you need to know.

Up-to-date Equipment

It pains us to say this, but a lot of payment processors are still offering antiquated, obsolete equipment.

As a matter of fact, it’s probably safe to say that most businesses in Canada are still using outdated payment terminals.

The fact that companies are still offering these terminals to avoid having to upgrade their equipment is an absolute disgrace, but unfortunately, it’s still happening.

Some of these terminals can’t even accept some of the most popular forms of payment, including chip-and-PIN cards and contactless payments, and that’s bad for both business owners and their customers.

So, you should do some research on the kinds of terminals companies are providing, call up the companies you’re considering to confirm that they’ll give you brand new terminals, and don’t ever agree to take used or outdated equipment, no matter how they try to sell it to you.

At Lucid Payments, we’ve invested in the most up-to-date equipment and infrastructure, because we’ve made a commitment to do what’s in the best interests of business owners.

So, if you’re having a tough time trying to choose a portable payment terminal, contact us today and let us know how we can help you.