When you own a business, you’re forced to make a lot of difficult decisions, and at some point, it’s bound to be overwhelming.

You have to consider a seemingly never-ending barrage of concerns, including things like expenses, taxes, regulations, marketing, hiring, training, and retaining a team of employees, and of course, figuring out how you’re going to process payments from your customers.

And when it comes to determining which payment processing provider is right for your business, this can be one of the most stressful decisions you’ll ever have to make.

Unfortunately, most companies in this industry aren’t making it any easier on business owners. If anything, it seems like they’re doing whatever they can to make things needlessly complicated.

This can end up making things so complex that business owners just pick a company at random and go with it because all they know is they need to be able to process payments.

But it doesn’t have to be this way.

Truth be told, it’s actually pretty easy to separate the wheat from the chaff and decide what’s going to be in the best interests of your business and your bottom line.

But you’ve got to know what to look for.

So, if you’re struggling to choose a payment processing company, then keep reading because this article is going to give you greater insight into how you can make this all-important decision.

What to Look for in a Payment Processing Company

Just like any other decision you’d make as a business owner, the best thing you can do is be as informed as possible.

So, instead of just randomly choosing a company, you should look into all your options and really take some time to think about what’s going to be best for your business.

There are a ton of things to think about when picking a payment processor, but the three points below are the most important things to consider, and understanding this stuff should make things a lot easier for you.

Security

Whenever you’re dealing with money, security should be the top priority.

These safeguards are absolutely essential for you, your business, and your customers, so it’s definitely not something you should take lightly.

No matter what payment processor you choose, you should ensure that they adhere to the standards set by the PCI Security Standards Council (PCI SSC), which is a global forum that works to enhance the security of card transactions and protect cardholders against the misuse of their information.

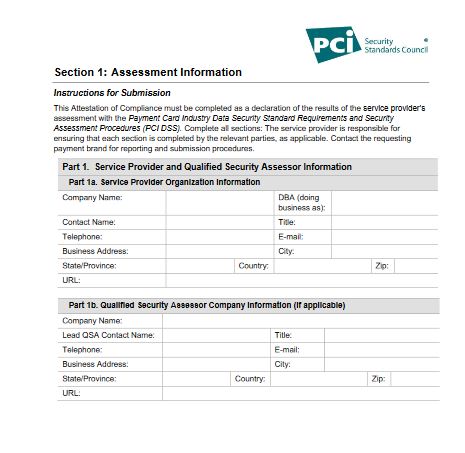

In order to verify that a company is compliant with these standards, the best thing you can do is ask them for a copy of their Attestation of Compliance (AOC). This document provides proof that they’ve met the standards set by the PCI Security Standards Council.

If you want to be extra careful, you should ask if the company you’re considering is working with any third-party service providers, and if so, contact them and ask them to provide their AOC(s), as well.

It’s also important to make sure the form is up to date, as these assessments are supposed to be done annually.

If the form is out of date, or a company is reluctant to give it to you, it’s probably best to steer clear of them, as these are definitely not good signs.

Here’s a screenshot of the first section of the form, just in case you’re wondering what it looks like:

Payment Acceptance

The next thing you should consider is what kinds of payments a company can process.

No matter what you’re selling, you don’t ever want to have to turn potential customers away because you lack the ability to accept their payments.

So, when you’re looking at the pros and cons of a payment processor, make sure to confirm what forms of payment their devices will accept.

At the same time, if you want to sell online, or you think there’s even a slight chance you might want to do so in the future, it’s good to ask them what forms of payment they’ll allow you to accept online.

You should confirm that they offer both eCommerce payment options, and virtual terminals, as well. Because with the way the world’s going most businesses are going to need these services at some point.

Also, you should make sure their online payment processing provides some form of direct currency conversion, so you can sell to people around the world without any hassle.

Even if you’re not selling online at the moment, it makes more sense to choose a company that offers every form of payment processing, including online payment solutions, as this can help you to avoid stress and confusion if you do decide to start selling online in the future.

At the very least, if you want to avoid turning people away, or inconveniencing your customers, make sure the company you choose will allow you to accept:

- EMV (chip-and-PIN) cards

- Contactless (NFC) cards

- Google Pay

- Apple Pay

Payment Terminals

Another important consideration is to look at what kinds of payment terminals a company offers.

The terminals we recommend are the Ingenico Desk/5000 and Move/5000, as well as the Poynt 5 smart terminal.

In our opinion, these are the best terminals on the market, and they offer some of the newest features, along with superb speed, functionality, an intuitive user interface, and the ability to accept virtually any form of payment.

That being said, you shouldn’t just go to a company’s website and check if they have these terminals.

Believe it or not, a lot of companies still rent out used or obsolete equipment, which forces businesses to inconvenience or even turn away their customers, as some of these terminals aren’t equipped to accept contactless cards, or even chip-and-PIN cards, which is ridiculous in this day and age.

In any case, once you’ve confirmed that a company offers these terminals, you should call them to make sure they’ll provide you with a brand-new terminal, and not something that’s used or outdated.

They might try to sell you on a beat-up old terminal by offering some sort of discount, but don’t fall for it. No matter how significant the discount might be, it’s just not worth it.

At Lucid Payments, we’re fully compliant with PCI standards, and we only offer brand-new feature-rich terminals and online payment solutions that allow you to accept virtually any form of payment.

So, if you’re struggling to decide which payment processor to choose, contact us today to find out how we can simplify your payment processing.