For most of us, the holiday season tends to be a particularly positive time of year.

We get to spend time with family and friends, give gifts to our friends and loved ones, and enjoy all the festivities that this time of year has to offer.

For business owners, the holidays are also filled with positive vibes, not least because they tend to be the most productive and lucrative time of year.

Unfortunately, the holidays are also a time when things like theft and payment fraud become more prevalent.

According to a report from Visa, during last year’s holiday season, the merchants who tend to be most targeted by fraud, including home improvement and supply, telecommunications, business-to-business, healthcare, automotive, entertainment, education, government, lodging, insurance, airlines, drug stores, and pharmacies, saw a significant increase in this kind of nefarious activity.

For these unlucky merchants, payment fraud increased by 11 per cent compared to the rest of the year, and actually went up 8 per cent compared to what we saw during the 2021 holiday season.

Clearly, the incidence of these crimes is becoming more common, and sadly, most businesses have pretty much come to expect this sort of thing around this time of year.

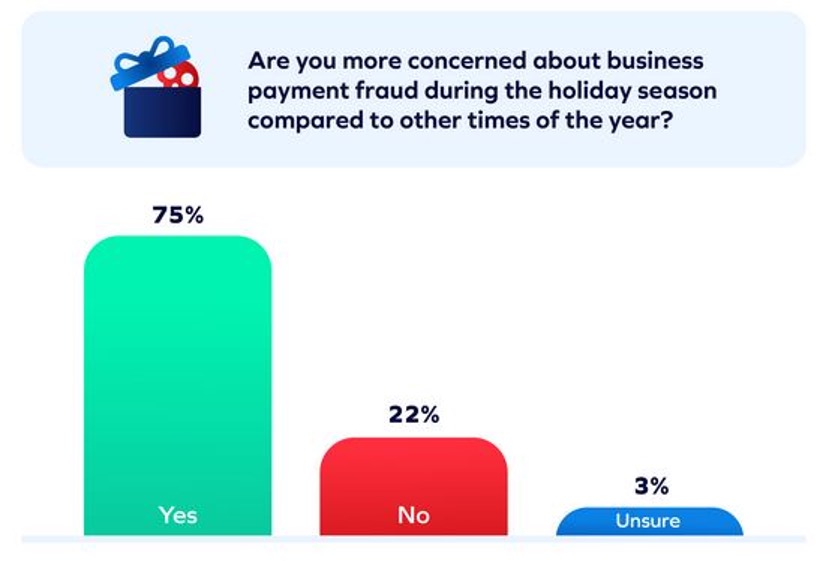

A survey from Trustmi confirms this, as it found that the vast majority of businesses are more concerned about payment fraud during the holiday season.

We’ve also been seeing this happening more frequently in our own backyard, and it breaks our hearts to see small business owners getting scammed like this.

According to an article from Global News, Exile Electronics, which is a Vancouver-based music store, was hit by three fraudulent transactions last year, totalling more than $20,000.

The article reports that “the credit card owner disputed the charges and was granted refunds, even though the equipment was long gone. The credit card company then came after Exile for the money.”

At this point, they’re on the verge of bankruptcy, but thanks to a GoFundMe they started, they’ve been able to raise even more than their goal of $13,955 thanks to about 250 generous donations.

All things considered, we want to offer some advice on how you can protect your business from payment fraud during the holidays, so we can do our part to help prevent these heinous crimes.

So, if you’re looking to learn about fraud prevention and want to protect your business against fraud this holiday season, then this is an article you’re not going to want to miss.

Why Does Payment Fraud Increase During the Holidays?

If you want to understand how to prevent payment fraud during the holidays, it’s important to know why these crimes are more common at this time of year.

That being said, there are many reasons why payment fraud tends to increase during the holidays, and this includes things like:

Increased Transaction Volume

The holiday season sees a surge in shopping and transactions, both in-store and online, and this higher volume of transactions creates more opportunities for fraudsters to exploit vulnerabilities.

eCommerce Growth

Online shopping continues to grow, especially during the holiday season, and this increase in online transactions provides more opportunities for cybercriminals to execute various types of fraud, such as card-not-present fraud or account takeovers.

New Account Openings

Some people open new accounts (credit cards, store accounts, etc.) during the holidays to take advantage of discounts or offers, and this presents an opportunity for fraudsters to create fake accounts or steal identities.

Fraudulent Gift Cards

Criminals may tamper with or use stolen credit card information to buy gift cards, which can be used for personal use or sold for cash, making them a target during the holiday season.

Lack of Vigilance

With the holiday rush and excitement, people may let their guard down or overlook suspicious activities, making it easier for fraudsters, as they can exploit this lapse in vigilance.

How to Protect Against Payment Fraud During the Holidays

All this talk about holiday payment fraud can be pretty depressing, especially if you own a business.

But the silver lining to all of this is that there’s actually a lot you can do to protect against payment fraud during the holidays, including:

Password-Protecting Refunds

We’ve heard horror stories of business owners hiring a new employee, only to find out after they’ve quit that they were handing out refunds to their buddies left, right, and centre.

With that in mind, make sure to password protect the ability to give refunds, and only provide that password to people whom you know you can trust.

Otherwise, you’re leaving yourself open to a scam that seems like it’s becoming increasingly common.

Prioritizing Card-Present Transactions

For some businesses, this won’t be possible, but one of the best things you can do to protect against payment fraud is to prioritize card-present transactions and limit card-not-present transactions.

Card-present transactions are one of the most secure forms of payment, as they utilize chip-and-PIN technology, so whoever’s using this form of payment will need to have the card in their possession and also know its PIN.

Again, this may not be practical for some businesses, but, if at all possible, you should try to limit the number of phone and online orders you’re doing, and if it’s applicable, you can even incentivize customers to make in-store purchases by offering them discounts if they make a purchase from your store in-person.

Batching Out More Frequently

Some merchants are used to only batching out their terminals once a week, but this can expose your business to serious risks, especially during the holidays, when you’ll probably be doing a much higher volume of sales.

Because if someone decides to steal your terminal before you’ve batched out, the transactions that are still on there probably won’t get processed, and you’ll lose all that money.

Moreover, all the payment data will remain on your terminal until you’ve batched out, and this puts your customers at risk for fraud, as well, as criminals can steal their information.

That being said, during the holidays, or whenever you’re doing a significantly higher volume of sales, make sure to batch out every day, as once the information is sent to your processor, it’s essentially locked in, and you don’t have to worry about anything being taken or lost.

Using Multi-Factor Authentication

If you enforce multi-factor authentication for online transactions, it can add an extra layer of security by forcing customers to use a combination of passwords, SMS verification, biometrics, or one-time codes.

Regular Security Updates and Patching

One thing that you’ll want to do all year round, not least during the holiday season, is to ensure software, systems, and applications are updated with the latest security patches, as outdated software can have vulnerabilities that criminals can exploit.

Using Advanced Fraud Detection Tools

Another thing you can do to protect against payment fraud all year round is to employ robust fraud detection systems, which can use machine learning and AI to analyze patterns, detect anomalies, and flag potentially fraudulent transactions in real time.

Monitoring Transactions and Setting Up Alerts

Something else you can do to prevent payment fraud is make a point of monitoring transactions regularly for any unusual or suspicious activity and setting up alerts for large transactions, multiple purchases within a short time, or transactions from new or unusual locations.

Customer Verification Processes

Implementing strong identity verification methods for new accounts or high-value transactions offers another way to protect against payment fraud. This could involve verifying personal information, sending confirmation emails, or requiring additional documentation.

Educating Employees

No matter what time of year it is, you should also make sure to educate your employees so that they can recognize potentially fraudulent activity, and create protocols for handling suspicious activities and reporting them promptly.

Secure Payment Processing Systems

It’s unlikely that you’ll ever come across a company with payment processing systems that aren’t secure, but it doesn’t hurt to ensure your processor is using secure and encrypted systems that comply with industry standards and protect customer data, both during transmission and storage.

The holiday season is here, and that means now is a great time to weigh your options and get a reduction on your fees! Give us a call today to find out how much you can save with Lucid Payments.