With everything going digital, it seems that each year, more of our information ends up floating around on the internet.

This data can be very lucrative for the companies collecting it and can also provide a wealth of conveniences for consumers who are willing to give it up.

But despite all the advantages of this data being available, its very existence in the digital world is like bait for cyber criminals who are looking to profit from that data in any way they can.

According to an article from American Banker, in 2022, more than 250 million consumer records were leaked as a result of data breaches.

And it seems like there isn’t a single company that’s immune to this sort of thing, as many of these customer data breaches have happened at some of the biggest banks and financial services companies in the world.

What’s more, people are becoming increasingly aware of these risks, so if businesses want to retain the trust of consumers, they’re going to have to do everything they can to protect customer data.

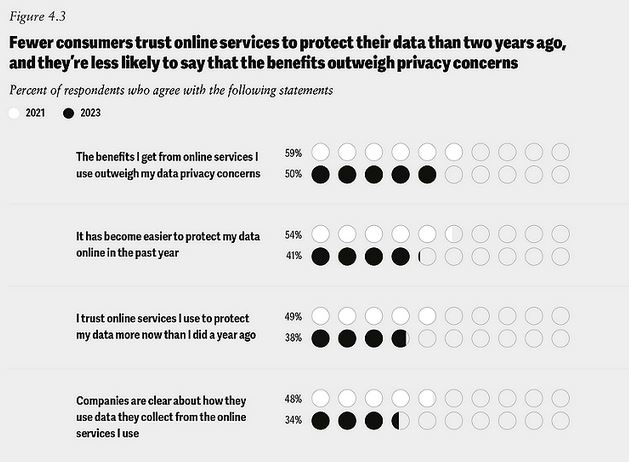

A survey from Deloitte found that the number of consumers who trust online services to protect their data has been decreasing, with only 38 per cent of respondents agreeing that they trust online services to protect their data more now than they did a year ago.

And a survey from KPMG, which polled both business leaders and consumers, found that data privacy is a growing concern for 86 per cent of consumers, and 40 per cent of them don’t trust companies to ethically use their data.

Moreover, the survey found that 62 per cent of business leaders say their organizations should be doing more to protect customer data.

As you can see, consumers are becoming more and more worried about this issue, and companies are well aware of their apprehension.

But with all the data breaches that have been happening, it seems like many businesses aren’t doing enough to protect customer data, and as we can see here, some of them are even willing to admit that, at least anonymously.

All things considered, ensuring the security of customer data is becoming increasingly important for businesses today, and the ones that do their utmost to protect consumer data will continue to gain the trust of consumers.

With that in mind, we wanted to publish an article explaining what you can do to protect consumer data, so you can ensure you’re doing everything you possibly can to protect your customers’ information.

So, if you’re concerned about customer data privacy, and you want to know what you can do to protect that data, then this article is definitely for you.

What You Can Do to Protect Customer Data

The obligation to protect customer data is not only a matter of business integrity but also a legal requirement in many jurisdictions, and data breaches can lead to significant financial losses, legal penalties, and irreparable damage to your company’s reputation.

With that in mind, below we’ve provided 15 tips on what you can do to protect customer data.

1) Implement Strong IT Security Measures

Having strong IT security measures in place is one of the best things you can do to protect your customers’ information. Here’s some of what that entails:

Encryption: Encrypting data ensures that even if information is intercepted, it cannot be easily deciphered. This is crucial for protecting sensitive information like credit card numbers and personal identifiers.

Secure Password Policies: Implementing policies that require strong, unique passwords for customer accounts and encouraging or enforcing regular password changes can add another layer of security.

Regular Software Updates: Keeping all systems and software up to date to protect against known vulnerabilities is something else you should be doing if you want to protect customer data.

Firewalls and Antivirus Programs: These tools can help you to protect people’s data by preventing unauthorized access and monitoring for suspicious activities.

2) Employee Training and Awareness

If you want to ensure the security of customers’ data, then you and your employees all have to be on the same page about this stuff.

That being said, this won’t always be relevant to what they do, but if it is, you should make sure employees are trained on how to handle customer data securely, including recognizing phishing attempts and avoiding common security pitfalls.

3) Data Minimization

With the amount of money that can be made from people’s data, collecting it can be tempting, but if you’re serious about protecting customer data, you should make a policy of collecting only the data that’s absolutely necessary for business purposes.

The less data you store, the less you have to protect, and that can significantly reduce the impact of a potential breach.

4) Regular Security Audits

Conducting regular security audits can help you to identify vulnerabilities in your systems, but this can be incredibly technical, and it may not be relevant to your business.

But if you do have systems that house customer data, you might want to consider hiring an external cyber security firm to perform unbiased assessments and ensure your systems are as secure as possible.

5) Come Up with a Response Plan for Data Breaches

Every second that passes after a data breach can result in further damage and loss of data, which is why having a clear, well-communicated plan in case of a data breach is integral to ensuring the security of customer data.

This plan should include steps for how you’re going to control the damage, notify affected customers, and cooperate with authorities, if necessary.

6) Secure Payment Systems

No matter what kind of transactions you need to process, it’s crucial to ensure you and any third parties you’re working with are using secure, PCI DSS-compliant payment systems.

And you should also avoid storing sensitive payment information on your servers, if at all possible.

7) Data Backups

If you absolutely must hold on to customers’ data, you should make sure to regularly back up that data in secure, encrypted forms.

This not only protects against data breaches but also against data loss, which can happen for a variety of different reasons, such as hardware failure, human error, power issues, theft, and even natural disasters.

8) Mobile Device Management

With the increasing use of mobile devices, if you want to protect customer data, you’ve got to ensure that any customer data accessed through a mobile device is secure, regardless of whether it was done through your device or that of one of your employees.

With that in mind, make sure to implement policies and procedures for how to manage the use of personal devices for business purposes and ensure all your employees are aware of the consequences of not following these guidelines, both for them and for customers.

9) Implement Multi-Factor Authentication

Multi-factor authentication adds an extra layer of security by requiring users to provide two or more verification factors to gain access to a resource like an online account.

If you’re dealing with customer data online, ideally, this should be made mandatory, but some customers might not appreciate that kind of imposition, so at the very least, make sure it’s strongly encouraged and that customers understand why you’re asking them to set up this feature.

10) Monitoring and Reporting

Setting up systems to monitor data access and usage can help you to spot any funny business before things get out of hand.

This type of monitoring can flag any unusual activities, allowing you to promptly investigate any issues and get to the bottom of things before too much damage has been done.

11) Vendor and Third-Party Management

It’s typical for businesses to work with third parties when handling or processing customer data, but this can also put customers’ data at even greater risk.

With that in mind, you should make sure that any third-party vendors or partners who have access to your customer data also adhere to strict data security standards.

12) Encourage Customers to Use Chip-and-PIN or Tap

Encouraging customers to use chip-and-PIN or tap (contactless) payment methods can significantly enhance data security, not least because both forms of payment reduce the risk of skimming, where fraudsters can capture card details.

Chip-and-PIN technology is more secure than traditional magnetic stripe cards because the chip creates a unique transaction code for each payment, making it extremely difficult to counterfeit.

At the same time, tap payments use short-range wireless technology to transmit payment information, which adds an additional layer of security.

If you do most of your business online or over the phone, you might not be able to do this, but the more you can get customers to use these forms of payment, the more secure their data will be.

13) Avoid Card-Not-Present Transactions

Again, if you do most of your business over the phone or online, then this might not be possible for you.

But, if at all possible, you should try to avoid processing card-not-present transactions, as doing so can help to reduce the risk of fraud.

Card-not-present transactions, common in online and phone payments, are more vulnerable as they don’t require physical verification of the card, making it easier for fraudsters to use stolen card details.

So, if you can, try to provide incentives for customers to actually come to your store in person, such as in-store discounts, so you can protect your business from fraud and your customers can benefit from the additional security of inserting their card and entering their PIN.

14) Batch Out Your Terminal as Often as Possible

You’d be surprised how common it is for business owners to only batch out their terminals once a week, or even less frequently than that.

However, the reality is, batching out your payment terminal as frequently as possible is crucial for protecting customer data because each batch of transactions stored in the terminal represents a trove of sensitive information, and the longer that data is retained in your system, the greater the risk it could be compromised in the event of a security breach.

But by frequently batching out – that is, transmitting transaction data to the payment processor – the amount of data potentially exposed at any given time is minimized, and the window of opportunity for cyber criminals to access and steal customer information is limited.

That being said, if you can, you should make sure to batch out your transactions every day. And if you have to leave that information on your terminal for any amount of time, make sure you put it in a secure place, preferably a safe.

Because if someone steals that terminal, they’ll have access to all that customer data, and the transactions that are on it probably won’t get processed, and you’ll lose all that money, as well.

15) Only Allow People You Trust to Access Your Terminals

We’ve heard horror stories about new employees who were given full access to payment terminals, with nothing password protected, and then proceeded to scam their employers by doing things like giving refunds to all their buddies.

And if people are willing to do that, who knows what they’d be willing to do with your customers’ data?

That being said, you should ensure that everyone who has access to your terminals is trustworthy.

In some cases, it might be hard to tell if that’s the case, but at any rate, you should make sure to password-protect your refunds and limit access to sensitive data to only those employees who absolutely need it to perform their job duties.

Are you still wondering if you’re doing everything you can to protect customer data? Give us a call today to gain greater clarity and find out how we can help.